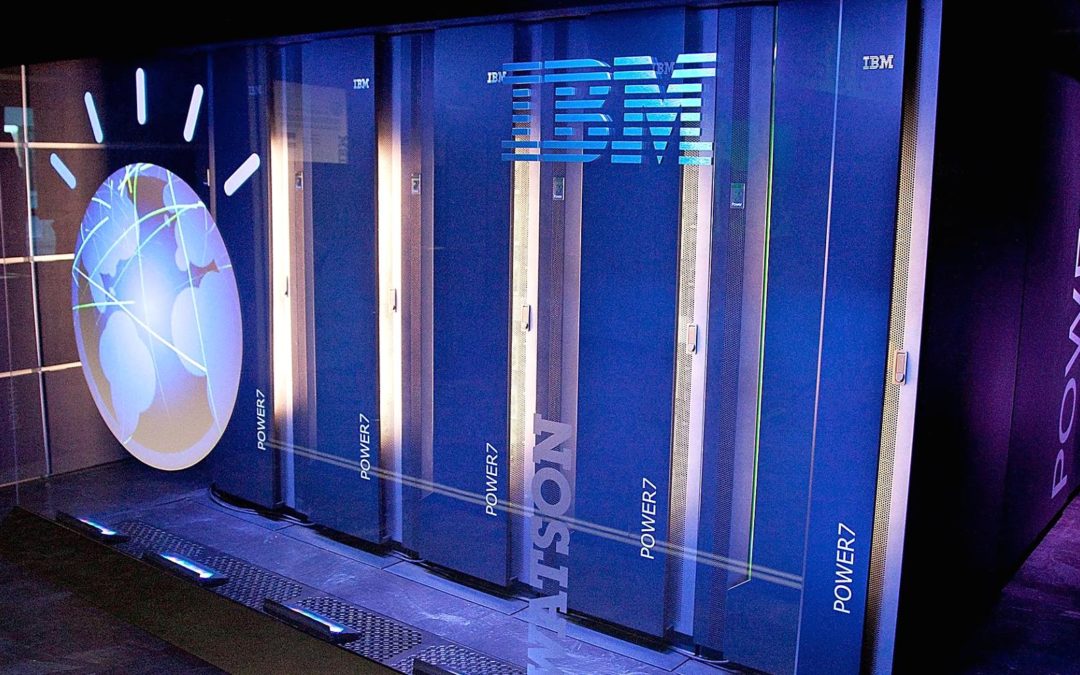

- IBM’s Watson artificial intelligence platform has been hired to help pick stocks for a new ETF.

- Algorithm-driven investing has beaten many human stock pickers in recent years.

- The world’s largest money manager, BlackRock, recently decided to supplement, if not supplant, its human portfolio managers with AI software for many funds.

Wall Street: Artificial Intelligence Stock Picking With EquBot and IBM Watson’s Supercomputer

Artificial intelligence stock picks have hit Wall Street. EquBot teamed up with IBM Watson to run portfolios using artificial intelligence to pick stocks. By using algorithm-driven investing, the AI system aims to achieve better performance than the U.S. broad stock market index.

Is this an AI assault on Wall Street? EquBot says it’s a necessary evolution to eliminate human bias from the investment process. In fact, algorithm-driven investing has beaten many human stock pickers in recent years.

EquBot with Watson’s artificial intelligence stock picking system is the first AI system that leverages the power of IBM Watson as a method for AI stock picks. Mimicking an army of research analysts, the platform reads and analyzes millions of traditional data sources — such as financial statements — as well as non-traditional data sources — such as news articles and social media posts — to make investment decisions.

Equbot, a technology-based company in San Francisco, is focused on applying artificial intelligence to pick stocks and analyze investments. Part of the IBM Global Entrepreneurs program, EquBot uses Watson’s artificial intelligence platform to pick stocks based on the probability of each company benefiting from current economic conditions, trends and world events. Their artificial intelligence stock picking methods identify companies for inclusion in the portfolio that have the greatest potential for price appreciation over the next twelve months.